Are you confused about whether or not you have to pay Zakat this year?

Don’t worry, with the one year rule, you could easily put that confusion to bed.

My Mercy extends to all things. That (Mercy) I shall ordain for those who have God-consciousness and give their Zakat and those who believe in Our Signs.”

(Surah Al-A`raf 7:156)

Introduction

Zakat is one of the five pillars of Islam. It has both economic and spiritual significance.

To know about the one year rule, there are a few basic concepts regarding Zakat that you need to understand first:

- Zakatable wealth: Zakatable wealth subtracted by relevant expenses.

- Time: Represented by the lunar calendar.

- Zakat audit date: 1 year after your zakatable wealth crosses the Nisaab level (in the Lunar year)

- Nisaab: Minimum Zakatable wealth at or above which you’re responsible to pay Zakat.

Misconceptions about Zakat

We are going to use an imaginary person, let’s call him Abdullah.

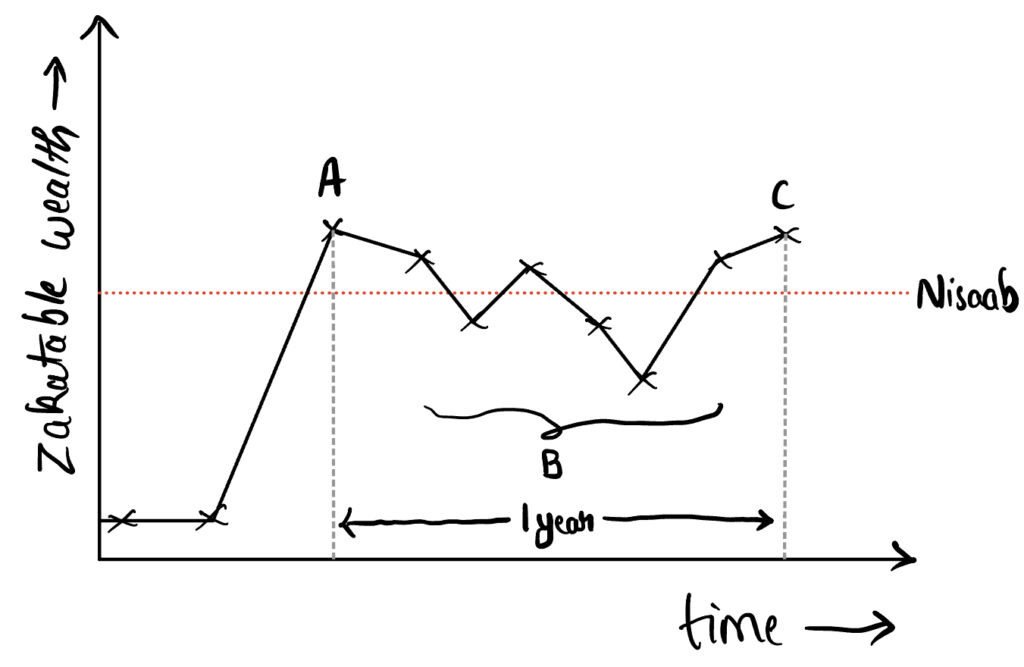

Abdullah has recently received his first paycheck. He is ecstatic. Removing all the expenses for the month including his necessities, Abdullah has Zakatable wealth that is above the Nisaab level. (‘A’ in the figure below)

As time goes on, Abdullah has some good months where he saves a lot and also some bad months where he saves nothing. Constantly hovering above & below the Nisaab level. (‘B’ in the figure below)

It is now 1 year since Abdullah’s first paycheck. Knowing he never truly held Zakatable wealth above the Nisaab level for 1 whole year, he assumed, he does not have to pay Zakat. Even though he received a silver ring as a gift a few days ago and this took his current Zakatable wealth above the Nisaab level. (‘C’ in the figure below)

Abdullah has two misconceptions about Zakat which ultimately has led him to not pay his Zakat.

- Zakatable wealth has to stay above the Nisaab line for the whole year. It should never go below the Nisaab line.

- The silver ring isn’t Zakatable as it is not in his possession for 1 whole year.

Debunking the misconception

Based on the Hanafi school of thought, A person is considered to be responsible to pay Zakat if he meets two conditions:

- Sound of mind, adult, muslim

- Having Zakatable wealth that is at or above Nisaab on the Zakat audit date.

NOTE: As long as you’re still at or above Nisaab level on the Zakat audit date, you would have to pay Zakat irrespective of the variation that happens within the year. This means that if you get any zakatable wealth even 1 day before your zakat audit date, you should consider that while calculating your total zakat on the zakat audit date.

Action plan for the one year rule

Here are the exact steps you should use:

- keep tabs on your Zakatable wealth on a day-to-day basis.

- Make note of when you cross the Nisab level. If the exact date is unknown, take your best estimate.

- Add a year to this date. This is the Zakat audit date.

- Forget whatever happens to your Zakatable wealth until the Zakat audit date.

- Check your Zakatable amount on the Zakat audit date. Irrespective of the variations that might have happened in the preceding year.

- In case you are above the Nisab level on the Zakat audit date, pay Zakat of 2.5% before the end of the Zakat audit date.

Sources

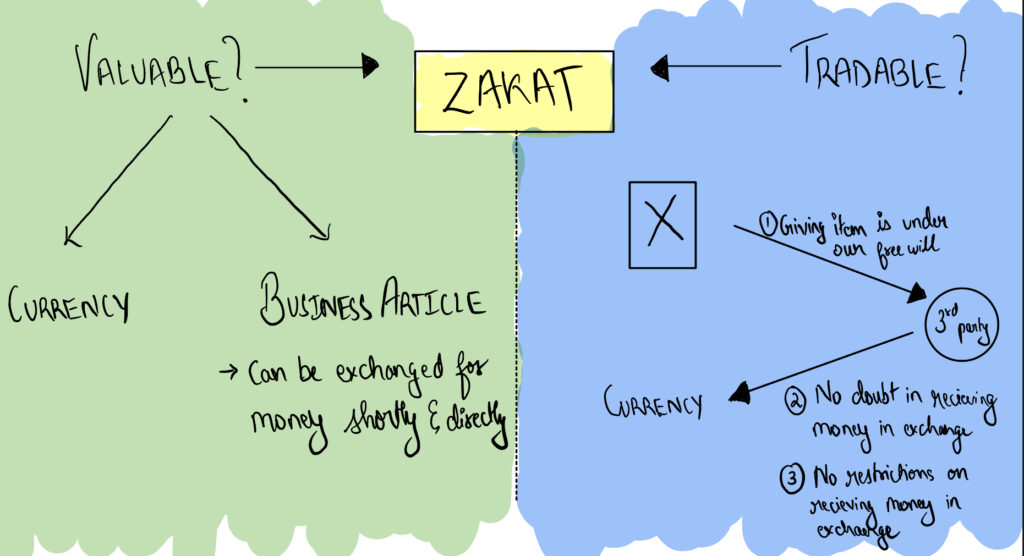

Join me in my next article where I give you a simple rule that will help you recognise Zakatable wealth in your possession without any confusion.

Comment your doubts below.

Nisaab: The line that separates rich & poor

What is Nisaab?How is Nisaab calculated?Nisaab according to silverNisaab according to goldGold or silver?Significance of…

Simplifying Zakat for the millennials: The 2 question checklist

Looking for someone to answer your questions about which of your wealth is Zakatable? Read…

Masha Allah

I appreciate your efforts.It’s of great help in payment of Zakat.May Allah increase your knowledge

Ameen. Thank you.

The article has been a good read. Perhaps could you please elaborate on when do you exactly become a nisaab? Is there a said amount?

Yes that’s a great question. Nisaab is the minimum amount of zakatable wealth that once reached or crossed makes Zakat compulsory.

Back in the days of the prophet, it used to be 200 Dirhams (made of silver). Based on calculations it has been founds that about 612g of silver was present in 200 Dirhams. This 612g of silver is used as the Nisaab value now. You need to check online what the current price of 612g of silver is, whenever you want to calculate Nisaab. Use this value as the threshold. Once you cross this threshold you become ‘Saheb e nisaab’.

There is something similar for gold as well. It is 87.4g of gold.

Hope this answers your question.

Assalamualaikum Saeed, Mashaallah, Very crucial information regarding Zakaat and Nisaab very well explained. Its the best of Sunday to seek knowledge and impart the same to others. This type of deeds also come under Zakate Jariya. Keep it up !.

Walekumas Salam. Glad you found it to be of help. Please share it with your friends & family. Thank you.

Very concise, explain the zakat audit date which is critical for the sahib e nisab to segregate zakat from his wealth for its distribution in the sake of ALLAH

Yes. It is very important but lots of people had confusion in this part. That is why I thought it was necessary to write about it. Thank you for reading it.

Alhamdulillah grt effort…do continue with such informative blogs… waiting for the next one…

Thank you very much for the kind words. Inshallah, I’ll try to post the next one within this week.

Pingback: Simplifying Zakat For The Millennials: The 2 Question Checklist | Sehat