Looking for someone to answer your questions about which of your wealth is Zakatable? Read this article to become that someone.

Table of Contents

Introduction

If you haven’t read my previous blog, make sure you read that before you read this. In my last blog, I introduced a term, Zakatable wealth, which is Zakatable assets subtracted by relevant upcoming expenses.

Zakatable wealth = Zakatable assets – Relevant expenses

Figuring out whether or not an asset is zakatable is confusing. Trying to learn individual scenarios is almost pointless. The purpose of this blog is to give you a universal rule that you can apply to almost any asset and find out whether or not it is zakatable.

Here are a few examples of how complicated it can get. Try answering whether or not Zakat is applicable on the following assets:

- Money which is used to lease a house for a period of 5 years.

- Money invested in shares.

- Gold which is currently pawned.

- Money which is present in a provident fund account before you have retired.

- Money which is loaned to someone and you’re not sure if you’re going to get it back.

2 question checklist

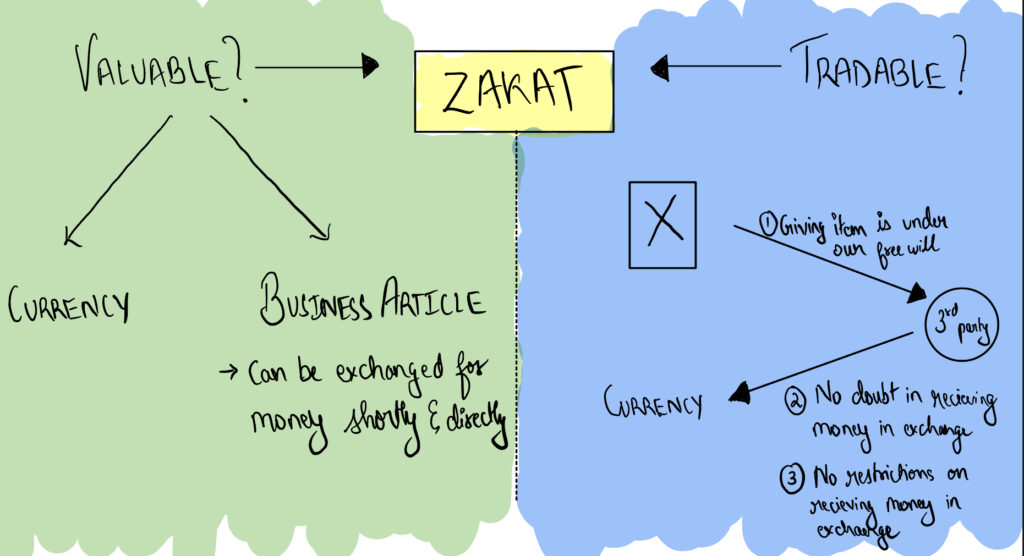

To figure out whether or not an asset is zakatable, ask yourself these two simple questions.

Is it valuable?

Is it tradable?

If the answer is yes to both, then the asset is Zakatable.

Valuable

For an asset to be considered of value:

1. it has to be a currency.

OR

2. a business article.

Tradable

For an asset to be considered tradable:

1. Giving it should be under our control.

AND

2. Receiving money in exchange shouldn’t be a problem.

Situations in which zakat is applicable on the article despite problems while receiving money during the trade (To prevent Zakat evasion)

2. When you create the problem

Summary

Examples

Wondering how it just doesn’t make any sense? Just solve a few questions with me and you will understand.

Conclusion

There can be a million different personal scenarios, but there can only be one rule. It is much better to learn this rule.

Sources

- Simple Zakat Guide: Understand and Calculate Your Zakat (Affiliate link)

- https://www.onlinefatawa.com/view_fatwa_english/44922

- https://www.researchgate.net/publication/320876927_Zakat_on_General_Provident_Fund_Misconception_or_Avoidance

- https://darulifta-deoband.com/home/en/halal-haram/32968

- https://ampindia.org/Guidelines_for_Salaried_Class

- https://www.askimam.org/public/question_detail/36420

- https://islamic-relief.org/zakat-faq/

Challenge questions

Just knowing about the rule does not mean you will be able to apply it correctly. It needs practice. For this purpose try commenting the answers to these challenge questions along with your thought process.

- Is there zakat on the shop where you have been selling toys?

- Is there zakat on your gold that you have currently given to your sister to wear?

- Is there zakat on the money present in your provident fund when you still haven’t retired and have been contributing the maximum possible amount?

- Is there zakat on the money that you knowingly loaned to someone who has a reputation for not returning loans?

- Is there zakat on the business articles that you haven’t managed to sell in over a year?

Comment your answers below.

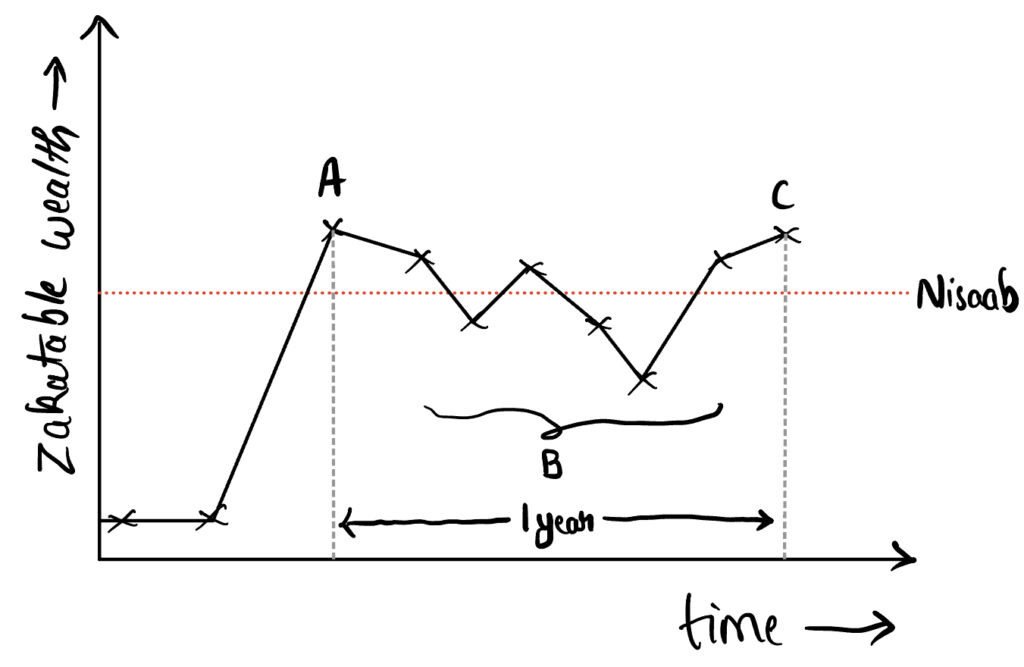

Nisaab: The line that separates rich & poor

What is Nisaab?How is Nisaab calculated?Nisaab according to silverNisaab according to goldGold or silver?Significance of…

Simplifying Zakat for the millennials: The 2 question checklist

Looking for someone to answer your questions about which of your wealth is Zakatable? Read…

Pingback: Simplifying Zakat For The Millennials: The One Year Rule | Sehat

Alhamdulillah

Great information in a nutshell

You have provided a thumb rule for calculation of zakath

More clarity in the article 2 will remove all the doubts

Kudos! Nice article.

Assalamualaikum, Mashaallah! Great Information.

Walekumas Salam,

Thank you. Try applying what you’ve learnt to solve the challenge questions.

Pingback: Nisaab: The Line That Separates Rich & Poor | Sehat